voluntary life and ad&d worth it

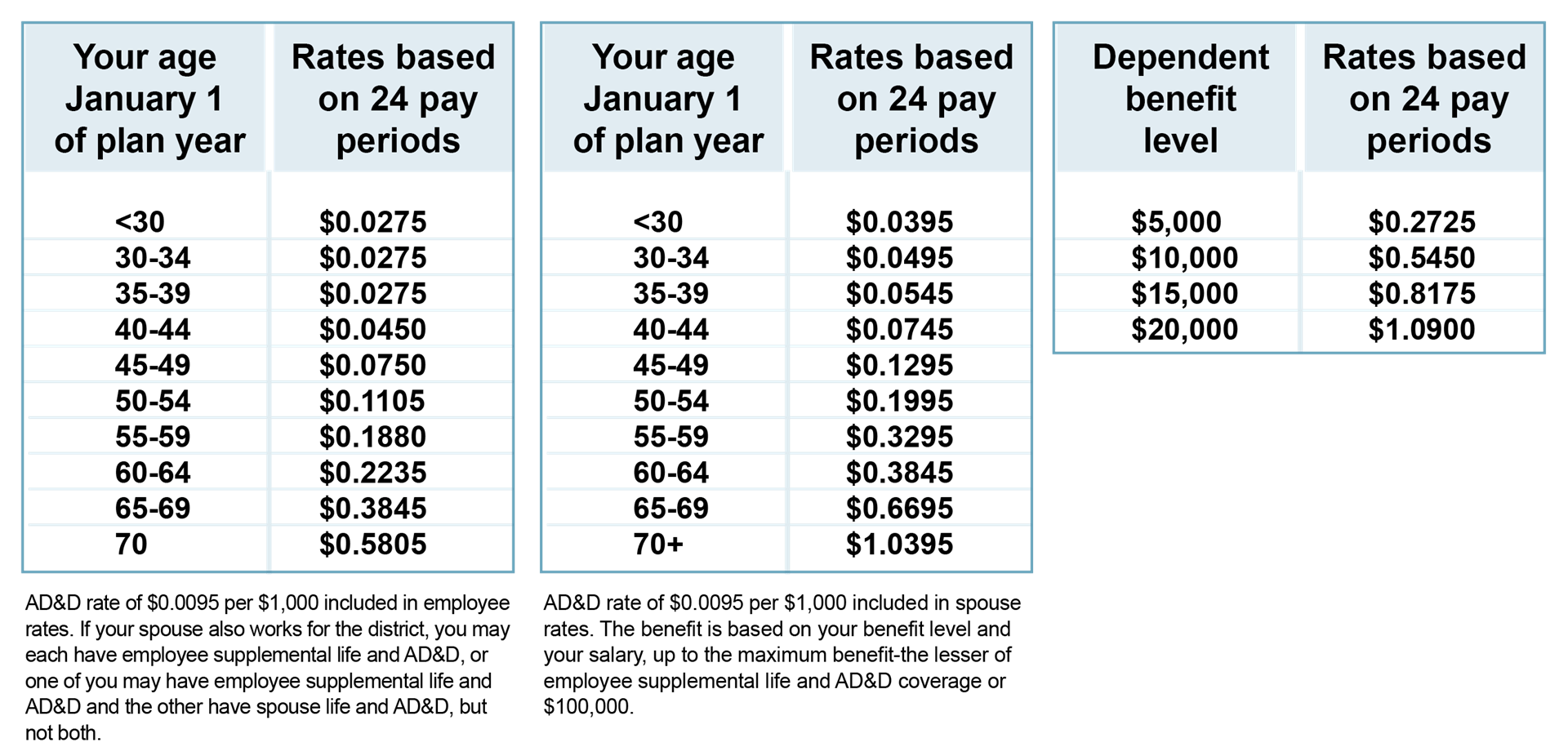

The premiums for voluntary term life are based on your age. Rates starting at 11 a month.

Term Life Insurance The Complete Definitive Guide

Voluntary life insurance is an employee benefit option offered by many employers to their employees.

. Accidental death and other covered losses occur rarely so ADD costs much less than term life coverage with similar limits. Get an Instant Free Quote Online. An ADD policy may be a good idea especially if you work in a high-risk job.

ADD will only pay a benefit if your loss is a result of an accident and there are plenty of ways to die other than an accident. Typically the group life is for included as a fringe benefit at no cost to the employee and is tax deductible by the employer. I would recommend getting the ADD as well as looking into a small whole life policy 10-20K because right now is the cheapest it is going to be.

Taking advantage of employer-sponsored insurance is a good way to secure. Voluntary life and ADD from work Many employers provide both life insurance and ADD coverage as a company benefit. Is voluntary employee life insurance worth it.

Supplemental ADD coverage could be a wise investment regardless but understand that ADD doesnt cover you for any type of death or dismemberment. See your rate and apply now. You can also purchase a personal ADD policy through your insurance agent often as a rider or add-on to your life insurance.

If you want both life insurance and ADD insurance a rider is a viable option. If the death is from natural causes your policy simply pays out the base amount. ADD insurance is not a replacement for life insurance.

Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. Ad Youre eligible to apply for exclusive term life insurance from New York Life. The voluntary life insurance would be additional insurance on top of this which you can purchase.

Reviews Trusted by 45000000. ADD is generally less expensive or in some cases an extra benefit to the current life insurance policy. Voluntary life and add worth it Saturday February 26 2022 Edit.

Updated Mar 31 2021. Browse Several Top Life Insurance Providers At Once. ADD insurance is supplemental life insurance and not an acceptable substitute Voluntary accidental death and dismemberment VADD insurance is an is relatively inexpensive compared to traditional term and whole life insurance.

You can purchase ADD insurance as a separate product or endorsement on your life insurance policy. Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is killed or loses a specific body part. For those with medical issues it might be the best and most cost-effective means to obtain life insurance.

Ad Our Comparison Chart Did the Work. You may only apply for. Is Voluntary life ADD worth it.

I believe as long as its below 50k it is not included as taxable income for the employee. ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. The premiums are tied to the amount of basic voluntary life insurance you purchase.

Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. This makes it an attractive benefit for your employees even if offered on a voluntary basis. With term life insurance the employee is covered for a specific term 1 5 10 or 20 years at which time the employee can either cancel or renew the policy.

What is voluntary Child life and ADD. The employee pays the monthly premium to the insurance company offering the policy. Just Click the Best Policy Buy Life Insurance Easily.

Rates will vary from insurer to insurer and can start as low as 450 per month for 100000 of coverage. What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance Accidental Death And Dismemberment Insurance Policy. No Visits to the Doctor.

An ADD rider also known as a double-indemnity rider pays out an extra amount if your death is accidental. You will have a guaranteed low rate for the rest of your life probably around 20month instead of getting a policy later when you are older might have picked up some bad habits or have been diagnosed with an illness. ADD holds particular appeal for young workers who statistically are more likely to die from accident than illness.

Apply Online and Save 70. Voluntary Life and ADD Insurance. Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or beneficiary with a cash payment.

Due to the low premiums VADD is sometimes attractive to younger people who may not have the income to support a full life insurance policy. People with riskier jobs pay higher premiums than people with low-risk employment. No Medical Exam - Simple Application.

The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits plan and you can typically purchase coverage for yourself your spouse or your children. Even for those with other policies purchased privately voluntary life can be an.

If youre young and unable to qualify for good rates from an insurer. It only covers accidents not natural death or injury from illness. For example if you had 100K life.

Voluntary term life insurance is the most common type of voluntary life insurance offered to employees. Ad 2022s Top Life Insurance Providers. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can.

Voluntary life insurance can be a valuable employee benefit. Ad Life Insurance You Can Afford. Ask an expert about life insurance companies that offer an ADD rider.

Term Life Insurance With Living Benefits 3 Best Companies

Aaa Life Insurance Review No Exam Policies And Discounts Valuepenguin

What Is Considered Accidental Death For Insurance Purposes Glg America

Voluntary Benefits Through Benefits For Life

Voluntary Benefits Life And Ad D

Ad D Vs Accident Insurance As We Always Point Out In Axis Capital Group Accidents Can Always Happen When You Least Expect It But Accident Insurance Ads Axis

New York Life Insurance Review Whole And Universal Life Valuepenguin

Life Insurance Plans American Fidelity

Is Term Life Insurance Or Permanent Life Insurance Better For You

What To Know About Ad D Insurance Forbes Advisor

Voluntary Life Insurance The Hartford

Voluntary Life Insurance Quickquote

Ad D Vs Life Insurance Differences How To Pick

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Ad D Vs Life Insurance Differences How To Pick

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance