amazon flex tax form download

You can plan your week by reserving blocks in advance or picking them. Amazon Flex Business Address.

Its almost time to file your taxes.

. 1099 Forms Youll Receive As An Amazon Flex Driver. 12 tax write offs for Amazon Flex drivers. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

We would like to show you a description here but the site wont allow us. Were investing in getting deliveries to customers faster all the time and people like you can help make it happen. And finally downloadprint your 1099-K for the year.

The password provided on the Tax Document Library page is required for opening the. Select Sign in with Amazon. Sign out of the Amazon Flex app.

Sign in using the email and password associated with your account. Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. From there select the Tax Document library.

1 Sign up for Amazon Flex using your existing Amazon account or by creating a new Amazon account 2 Provide answers to questions that well use for a background check 3 Select a service area where you will pick up and deliver Amazon packages 4 Watch the videos to learn best practices for delivering with Amazon 5 Provide tax and payment. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. I went to tax central to download a copy and it says no file to download.

Submitting Apps to the Amazon Appstore. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Deliver smiles Amazon delivers millions of items each year delighting customers around the world.

Set your own hours. I can go to download it it says no files found. 45 out of 5 stars.

Tap Forgot password and follow the instructions to receive assistance. Why Flex Lets Drive Locations FAQ. Amazon is a multibillion-dollar Goliath but even they make occasional mistakes.

Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. I saved the PDF to my computer but I no longer remember the password. Or download the Amazon Flex app.

The main tax form you need to file is Schedule C. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. Amazon Flex quartly tax payments.

This is where you enter your delivery income and business. Taking Screenshots on Fire Devices. More than 20000 in unadjusted gross.

Blue Summit Supplies 1099 NEC Tax Forms 2021 50 4 Part Tax Forms Kit Compatible with QuickBooks and Accounting Software 50 Self Seal Envelopes Included. The Amazon Flex app gives you access to. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

Increase Your Earnings. 46 out of 5 stars. Adjust your work not your life.

Amazon Flex Legal Business Name. No one does flexibility like Amazon Flex. The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances and reliefs.

The 153 self employed SE Tax is to pay both the employer part and employee. How to Calculate Your Tax. Download Amazon Flex and enjoy it on your iPhone iPad and iPod touch.

Get it as soon as Wed Feb 23. Most drivers earn 18-25 an hour. What if my 1099-K form is inaccurate or I didnt receive one.

A new password will be provided. Due to Internal Revenue Service IRS regulations US third-party settlement organizations and payment processors including Amazon are required to file a Form 1099-K for US taxpayer sellers who meet the following thresholds in a calendar year. Do it your way.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. 1099 MISC Forms 2021 4 Part Tax Forms Kit 25 Vendor Kit of Laser Forms Designed for QuickBooks and Accounting Software 25 Self Seal Envelopes Included. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity.

Ive been back and forth with flex support and they keep sending the same fucking form answer and not listening. Report Inappropriate Content. Click ViewEdit and then click Find Forms.

Driving for Amazon flex can be a good way to earn supplemental income. Migrating An Existing App to the Amazon Appstore. Lets take a closer look at what this means.

Choosing a Category for Your App. Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. If Amazon didnt issue you a 1099-K form contact Seller support.

Log In and Add an App. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. How can I get another copy of my Form 1099-K.

Click the Download PDF link and enter the new password. Gig Economy Masters Course. Amazon Flex Business Phone.

Amazon Flex EIN. Im trying to finish up my taxes. With Amazon Flex you work only when you want to.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. I never got my 1099 from Amazon but I did get my W2s.

FREE Shipping by Amazon. Class 2 National Insurance is paid as a set weekly. IRS Form 1099-K Form Generation and Payee Information FAQ.

Knowing your tax write offs can be a good way to keep that income in your pocket. Get it as soon as Thu Feb 3. Or download the Amazon Flex app.

Add Availability Pricing. Click Download to download copies of the desired forms. 410 Terry Avenue North Seattle WA 98109 What forms do you file with your tax return.

For your security your tax form is password protected.

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

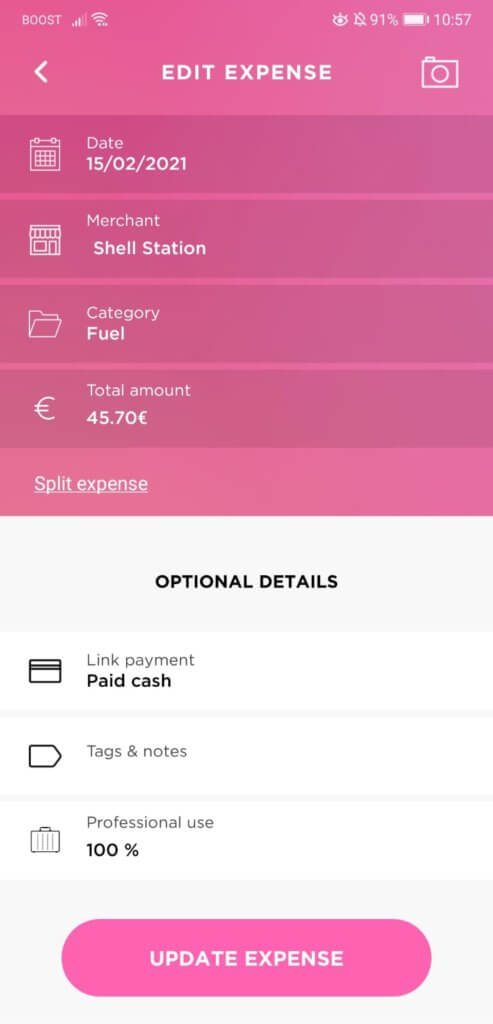

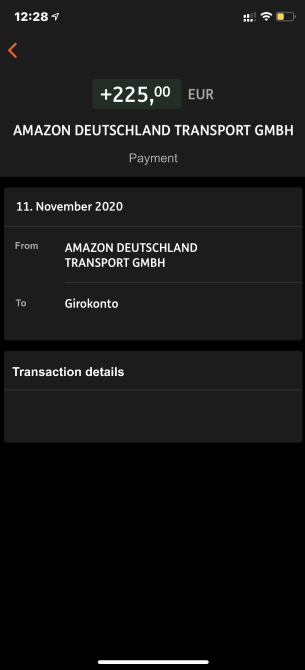

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable